This is a series of posts about our latest endeavor as newbie house flippers! We give updates every few weeks on our house flipping adventures that include timelines, budgets, problems, and before + afters. If you want to start flipping houses, I hope you'll follow along with this series!

Week 1

Weeks 2 + 3

Weeks 4 + 5

Weeks 6 + 7

Weeks 8 + 9

Update

Bathroom Before + Afters

Kitchen Before + Afters

Laundry/Mudroom Before + Afters

Living Room & Dining Room Before + Afters

Bedrooms Before + Afters

Exterior Before + Afters

I cannot tell you how happy I am that the Avenue House is officially CLOSED. Brian and I both walked around for days after it sold chirpily saying, "We don't have to work on that flip house ever again!" If you've followed along with this renovation, you know things did not go smoothly. True to form, the selling process of this house did not go smoothly either!

We had set a goal completion date of 9/4 for the remodel, but a few setbacks delayed us a few days so we ended up listing 9/14. When we purchased the home, we anticipated a sales price after the renovation of about $115,000. We ended up listing at $125,000 to give us some wiggle room for negotiations and hopefully end up around $115,000.

Right off the bat when we went live, we had a decent amount of showings, but the buyers were way more picky than we expected. Most of the houses in this area are in bad shape (like haven't been touched since the 70s) so I thought they would be blown away by how updated it was, but people seemed to harp on the fact that the windows are original (gorgeous wood ones, by the way). After a few days on the market, we received a cash offer for $95,000. Um, no. We didn't respond right away, and then they upped their offer to $100,000. We countered at $112,000, but eventually came down to accept a purchase price of $105,000. Not our ideal price, but quick close and all cash does hold some value.

The weekend came and went, and we got a text from our real estate agent that the cash buyers are backing out because their furniture doesn't fit. Fantastic. So back on the market it went. This made me nervous because to me a house that goes back on the market can look like damaged goods. Why didn't the first buyer want it? What's wrong with it? However, just two or three days later, we had a much stronger offer. Not cash this time, but $122,000 with $8,000 in concessions for closing costs and new windows (again with the windows!). We countered at $124,000 and settled at $123,000 with $8,000 back bringing our net price to $115,000 (exactly where we wanted to be!).

A few weeks go by as the buyer does her due diligence and then about two weeks prior to closing we get another text from our agent that the house only appraised for $105,000. Are you freaking kidding me? I thought that number was VERY low considering all of the system and cosmetic upgrades the house has (all new plumbing, HVAC, insulation, brand new kitchen and bathroom, etc). Basically in this situation, there are two options:

- The buyer comes up with the difference in cash

- The seller comes down on the purchase price to meet the appraised value

The market we are in is definitely a buyer's market so the first option wasn't going to happen. If we were in Raleigh still, maybe, but we knew we as sellers were going to be the ones sacrificing in this scenario. We ended up coming down to the $105,000 purchase price, but we took the $8,000 back for closing costs and new windows off the table. So instead of a $115,000 net sales price, it was $105,000. It was really hard to swallow a $10,000 profit loss, BUT, we knew this could happen. Flipping in an up and coming area where there aren't many renovated homes was a risk we took. In the end, we still made money and learned another valuable lesson. Turns out this house was just destined to sell at $105,000, haha.

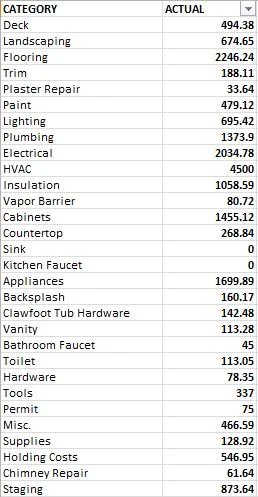

When we scouted out this house, we anticipated a renovation budget of about $25,000 and miraculously, we came in nearly $4000 under budget! I am so glad we did because that helped balance out the much lower sales price we were not expecting.

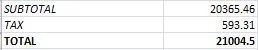

If you recall, we purchased the home for $52,963.75, so with the renovation/holding costs coming in at $21,004.50, our total investment was $73.968.25.

$105,000 sales price - $73,968.25 investment - $7,331.19 closing costs = $23,700.56 profit

Now, roughly $24,000 in profit is a good chunk of change, but if you look at this at an hourly wage, our profit kind of sucks, haha. We put in over 700 man hours on this renovation between Brian and I, which leads to about a $33.85/hr wage. Considering these hours were basically like overtime hours on top of our regular 9-5 jobs, this flip wasn't a huge financial success. To work that many extra hours, have your money tied up for that long (6/2-11/2 so five months exactly!), and carry that kind of risk, I would want to have at least $50/hr hourly wage.

For example, if you look at our previous flip (Dalton House), the profit was $36,721, but we only spent about 350 man hours on it, which gave us an hourly rate of about $105. (Who would have thought a trailer would be so much more profitable than a character filled craftsman house?!) That's the thing about flipping - you just never know how it will turn out!

Avenue House Flip Breakdown

Lessons learned from our second flip:

- Don't flip old houses. Unless the house is in a FANTASTIC location and you get it for a FANTASTIC price. We did neither with this house. Again, if we were in downtown Raleigh and could buy a rundown historic home for $250,000, put in $100,000 in renovations, and then sell for $500,000, then heck yes, flip that old house. But alas, this is Morganton and little old houses downtown just don't carry the same value as they would in a larger city.

- Know your comps. This house was hard because there are no other renovated houses any where close, so we gambled and anticipated a higher appraised price. Clearly, we were off.

- Buy larger homes. Two bedroom/1 bathroom houses are going to cut out a large number of prospective buyers. Going forward, we really need to target three bedroom/two bath homes (or larger).

- Staging is worth it. We did more staging this go around (every room!) and I don't think we would have sold for what we did without it. Staging is a biatch when you do it yourself, but the listing photos turn out so much better and buyers can really envision how they can use the spaces during a showing.

- Don't slack on the details. Towards the end of a flip, you just want to be done. By that point, I really don't care all that much and kind of want my life and money back, haha. But it is that last 10% that can make all of the difference. The extra little touches that will seal the deal. Case in point, the buyer of the Avenue House wanted to make sure the cup holder/rack on the fridge conveyed with the house. Take the extra time to make the house feel less like a flip and more like a thoughtful home.

That's a wrap, folks. It's been one heck of a year since we started these flipping shenanigans. We're looking forward to a break from constantly having paint in our hair and sore backs, haha. Although we don't plan on buying another flip in the near future, I know we can't pass on a good deal so we'll see. :) Thanks for following along!